What is a financial controller? The role & keys to effectiveness

Published on March 23, 2024

)

In some ways, financial controllership can be a difficult role to define. It straddles the divides between pure accounting, finance strategy, and leadership.

Good financial controllers need to have both keen attention to detail and the bigger picture in mind. They're tasked with ensuring accuracy but also improving efficiency - two goals that often butt heads.

And, as with most modern job descriptions, this role is evolving. Companies expect more strategic vision than they used to, and many financial controllers actively seek these challenges.

With all this in mind, let's explore the role, responsibilities, and goals of financial controllers fully. Starting with a clear definition of their scope.

What is a controller in finance?

A financial controller essentially is a company’s lead accountant. They oversee accounting activities and ensure that ledgers accurately reflect money coming in and out of the company. Strategic controllers also impact decision making, forecasting, and budgeting at the company level, based on accounting data.

Note: This role is also sometimes known as the “comptroller.”

From The Strategic CFO: “A controller is responsible for the accounting and record keeping of an organization. Additional responsibilities can include management of information technologies, insurance, sales tax reporting, federal income tax reporting, outside CPA audits and human resources. Controllers are in essence responsible for the financial and regulatory compliance of the Company. Think of controllers as the 'historians' for the company.”

Responsibilities typically include:

General accounting oversight

Creating internal policies and spend controls

Coordinating external tax accountants

Setting up bank accounts

Ensuring payment is received from customers and other debtors

In some instances, the role also includes a fair amount of project management. In smaller finance teams, the controller may also be the Head of Finance or Chief Financial Officer (CFO). They need to manage both these “control” aspects of the role, as well as creating financial reports, building budgets, and planning company spending.

So when companies are looking for a financial controller, the scope of the role can vary significantly.

The financial controller job description

The FC is a senior leader in the finance team. For this reason, it’s usually expected that job applications show significant experience in accounting and tax issues, plus the ability to guide others and take ownership of the company’s books.

This requires more than simply a gift for numbers. Controllers need to be organised self-managers, with the skills to compel the wider company to follow policies and procedures.

According to Randstad, “As the critical link that binds finance to the entire senior management team, you need to be a good communicator and to understand the entire business, not just the ins and outs of your own department. This means that a financial controller needs strong leadership skills, interpersonal flair and more than a touch of charisma.

“The need for partnering means that financial controllers must carry out their financial – and highly technical – role within the entire business environment. The so-called soft skills are just as important as the hard figures.”

Controlling vs accounting

As stated above, the controller is intricately involved in the company accounting process. And in many cases, they will do a lot of accounting day to day.

But in larger finance teams, there’s a clear distinction between the two.

Accounting

Accounting is the act of recording the company’s transaction data. This includes money coming both in and out of the business. Thus, accountants are primarily concerned with recording figures accurately and as smoothly as possible.

Obviously this is overly simplistic, but that’s the concept in a nutshell.

Controlling

As explained above, controlling is more concerned with ensuring that recorded data is accurate, on time, and within the rules set by the company. When there’s a discrepancy in the books, the controller’s should spot it, figure out what happened, and follow up with the parties involved.

They’re also typically in charge of policies and procedures to ensure that the right transactions are made by employees. The most obvious example is expenses - the financial controller is typically tasked with creating an expense policy and holding team members accountable to it.

Both accountants and financial controllers are involved in the financial close process - balancing the books at the end of every fiscal period, to start the next period fresh.

Controller vs CFO

This is another interesting dynamic. In smaller finance teams, the controller and CFO may even be the same person.

The CFO is both the leader of the finance team and a member of the executive leadership. On the one hand, they have to ensure that the finance team is well run and that everyone all the detailed work is done. On the other, they have to make strategic decisions to help the company achieve its potential. This can include working hand-in-hand with the CEO and presenting reports to the board.

For this reason, the CFO isn’t necessary an expert in accounting. They may have come from a consulting or entrepreneurial background and be more adept at matters of efficiency or financial planning.

But the financial controller needs to be an expert in the books. If they can’t quickly spot tax or balance issues in a ledger, they’re not going to be effective in the role. More importantly, they need to be able to identify the right technicians to do the majority of this work for them.

This quote from an EY report sums up the relationship well:

“The difference between the CFO and the FC is that the financial controller is more like the financial operating officer. They make sure everything is running well, there are no surprises, and the audits are good. The CFO keeps on top of the numbers, but has a big external focus in positioning the company with our investors.”

Keys to effective controllership

It’s not enough to simply know the financial controller role. There are clear ways to be more efficient and effective in this position, and to move from simple data processing to trusted business partner.

Here are some keys to doing this.

Automate, automate, automate!

As every accountant is well aware, recording financial transactions still requires plenty of manual data input. And it’s not just the first time around - errors discovered late in the day mean you then have to go back and re-enter much of the data you’ve already dealt with.

In many cases, this is wholly unnecessary. Most transaction data can in fact be entered and copied across systems without a human touch.

At the very least, make sure you’re not inputting data more than once. Where you use multiple systems - invoice processing, expense management, and procurement, for example - they should all speak with your accounting systems and/or ERP. Information should be up-to-date across all of these, and it shouldn’t rely on you and your team to achieve this.

Here’s how you can automate expenses or your audit trails, just for starters.

Practice clear communication

According to EY’s report, the biggest gap between importance and performance for FCs (as rated by themselves) is communication. The FCs polled felt that communication skills were incredibly important, and that their performance in this area fell short. This was followed by leadership skills and technical accounting acumen.

This of course means communication within the finance team and to direct reports. But one area that consistently needs work is communication with the wider company. Finance teams rely on other teams - sales, marketing, and purchasing among others - to follow policies and feed them useful data.

The big challenge here is to help others understand why good data is so valuable, and to set up efficient communication channels to get this across. Many finance leaders still fail to understand that just because a policy is written down somewhere, this doesn’t mean that others will actually follow it.

Give other teams autonomy

Another key issue with many finance processes is that they tend to rely on the finance team throughout. Take invoice processing, for example. In a typical company, it looks a little like this:

A frontline employee receives a service from a supplier (freelance advice, for example)

The supplier issues an invoice and sends this to the employee

The employee sends it to their manager for approval

The manager approves the invoice

The employee sends the invoice on to the finance team

A finance team member has to extract the key information from the invoice, enter it into a tool (or basic spreadsheet), and save it to the appropriate place

The invoice is later paid as part of the normal cycle

Accountants then have to rationalise the invoice against payments made by the company in order to close the books

Suppose, instead, that the employee could receive the invoice and enter it themselves into an invoice processing or spend management tool. No emails have to be sent, the manager can approve the invoice natively in the application, and the finance team has no data entry at all - all the way through to accounting.

Even better, employees learn how to create and process a valid invoice. This prevents problems occuring again and again down the road.

Learn more about invoice processing automation.

Strategist & catalyst vs steward & operator

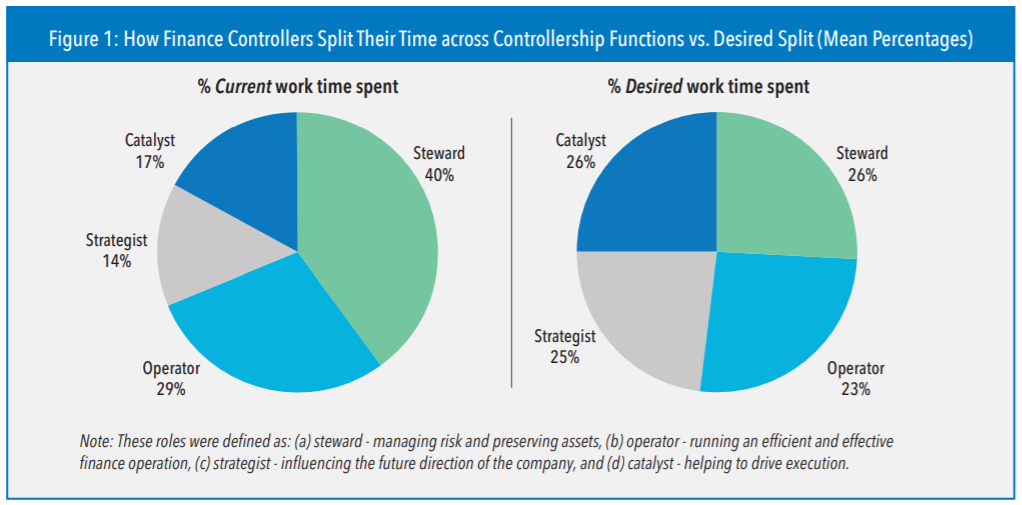

A fascinating report from IMA and Deloitte explores the controller’s role in detail. The authors segment typical controllership into four main categories:

Steward: managing risk and preserving assets

Operator: maintaining efficient and effective finance operations

Strategist: shaping the future of the company

Catalyst: helping to drive execution

Most controllers do all four of these. But according to the report, most feel that they spend too much time on the first two - the more traditional, functional roles:

Image source: Stepping Outside the Box: Elevating the Role of the Controller (IMA / Deloitte)

The simplest reason that most financial controllers aren’t considered “strategic controllers” is that it’s not an explicit part of their job descriptions. CFOs and FP&A leaders are there for the strategy, and controllers are there to control.

Therefore, the best way to make a financial controller role more strategic is to put it in the job description. Make strategy one of the defining characteristics of success for a financial controller, whether that’s you or the person you intend to hire.

Spend management for financial controllers

As we’ve seen, managing company spend is a key goal for most financial controllers. But spending and expenses are the leading causes of a messy financial close process.

The reason? Too little visibility over company spend, and poorly formatted data from the beginning. If you wait until the end of the process to see what’s been spent, you’ll always find frustrating and time-consuming “surprises” each month.

Instead, best practice is to have an integrated expense or spend management system that shows you what’s being spent in real time. Instead of waiting for expense claims to arrive at the end of the month, employees file them directly from the coffee shop on their laptop or mobile phone. Rather than poring over credit card statements, you have a dashboard with every payment and the person who made it.

For accountants and controllers, this is a gamechanger. It takes a process that once was days every month, and turns it into mere minutes.

To see how much time and money your company could be wasting on the expense report process, use this free calculator:

)

)

)